The initial stages of the COVID-19 pandemic resulted in three-month sustained decreases in operative and outpatient clinical volume as well as a “severe” financial loss for a U.S. academic vascular surgery division, researchers from a prominent health system in an early epicenter reveal.

Both clinical volume and profit margins “returned to pre-pandemic values in month four” of the pandemic, a trend that has been sustained through the early part of 2021, said first-named author Clayton J. Brinster, MD, associate program director of the vascular surgery fellowship training program at Ochsner Health in New Orleans.

Brinster delivered the findings during a rapid-fire presentation session at the 2021 Southern Association for Vascular Surgery (SAVS) annual meeting, held in a hybrid format from Scottsdale, Arizona, Jan. 27–30. He was part of a research team led by senior author W. Charles Sternbergh III, MD, professor and chief of vascular and endovascular surgery at Ochsner.

Brinster outlined the still-evolving widespread financial impact of the pandemic on the U.S. healthcare system. He said the Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law in March 2020 to help offset losses—but was based “only on an estimated total financial loss of 7–15%.”

A total of $323 billion was expected to be lost through October 2020, yet just $175 billion in healthcare relief had been allocated, Brinster pointed out.

He drew attention to data showing the quarterly average of national healthcare system operating margins from 2018 through the fourth quarter last year: The CARES Act did offset the “rapidity and severity of losses in the second quarter but that the severe losses are not only ongoing but they’re progressing into the fourth quarter.”

He added, “The bottom line is that most healthcare systems already function at a slim-to-negative financial margin, and that CARES Act relief funds have helped hospitals and healthcare systems—but they represent only a fraction of the losses incurred so far.”

So Brinster et al set out to examine the continuing evolution and impact of pandemic-induced financial changes within their academic vascular surgery division at Ochsner in New Orleans.

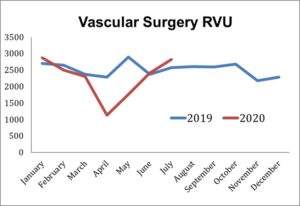

Operating room (OR), catheterization laboratory, vascular lab and outpatient clinic volumes were reviewed. Financial returns and margins, insurance payor mix and relative value unit (RVU) generation were recorded, with the respective trends analyzed.

Two intervals were established for comparison, Brinster explained—the first a pre-COVID interval of 14 months including January 2019 through February 2020, the second a COVID cohort with data from March 2020 to November 2020.

“When we look at procedure volume through the early pandemic, it predictably decreases sharply an average of -31% per month over the first three months of the pandemic. This, of course, is due to major restrictions on elective cases and other features limiting patient interaction during those months,” Brinster said.

“When we trend our own cath lab volume in our division through the end of the year, we see a rebound toward the pre-COVID values in the three-month cohorts examined in 2020.

“When we look at the RVU pandemic trends, we see, of course, another sharp downturn in those three early pandemic months of 32% per month, but actually overages of 13% and 8% respectively in the following months.

“Perhaps the most accurate estimation of financial generation and health of a division is, in fact, the hospital margin generated by the division. This is basically an estimate of total professional revenue on an in- and outpatient basis. We see sharp down trends 52% in the negative from March, April and May of 2020, but a rebound to within 1% of pre-COVID values for the next two three-month cohorts, which is encouraging.”

Turning to recovery, Brinster revealed the projected overage requirements that would be needed to achieve financial equipoise in light of the financial loss incurred earlier in 2020: Based on simple extrapolation modeling, he explained that “aggressive margin overages of 10% per month for 15–16 months would be required to make up for that three-month deficit of 2020.”

Furthermore, a less aggressive “but still very challenging” 5% per month overage would be required for 31–32 months to make up for the financial loss during the early part of the pandemic, Brinster said.

Concluding, Brinster said: “The early pandemic resulted in a three-month sustained divisional loss that was severe. Clinical volume and profit margins returned to pre-pandemic values in month four of the pandemic, and that has been sustained through the early part of 2021. We saw the CARES Act supplementation grossly underestimates the acute and long-term financial need, and aggressive monthly overages and salutary return would take years to achieve financial equipoise without supplementation.”

‘Unanticipated’ major decreases in cases of acute stroke

Leading questions of the findings, rapid-fire session moderator Benjamin J. Pearce, MD, associate professor of vascular surgery and endovascular therapy at the University of Alabama at Birmingham, drew reference to further research presented by Ochsner researchers on Friday, Jan. 29, that detailed “unanticipated” major decreases in cases of acute stroke, interventions for acute stroke, and telestroke consults at a comprehensive stroke referral center in a pandemic epicenter—namely, New Orleans.

Pearce asked: “You bounced right back, but you have done an overage of cases, looking at your case volumes—so where are those cases that didn’t get done during your downtime?”

That’s a question the the team at Ochsner is attempting to answer, Brinster responded. “As you mentioned—and alluded to our stroke abstract—it’s all theoretical and based on assumption of changed behaviors due to the pandemic, with people afraid to come into the hospital, elderly populations not being checked on, a lot of noise in terms of communication to patients about when they should, or if they should, be coming in for follow-up.

“No one has any clear answers, but in terms of targeted strategy from the business end of things, it seems to be a four-pronged approach. One of those approaches is the supplementation of normal clinic approaches with an investment in telehealth to maintain an outreach in terms of new referrals, maintain relationships with primary MDs, renew prescriptions, etc. That’s not really an answer to where did they go, but how to capture them moving forward.”

William Shutze, MD, a vascular surgeon and partner at Dallas- and Plano-based Texas Vascular Associates, probed Brinster on how the loss incurred during the fallow period would be achieved from a process point of view. “If your goal is to make up your loss during this free period of time with overages going down the road, there’s going to have to be adjustments made within the processes,” he said. “You’re going to have to expand OR capacity and clinic capacity, and those are two barriers that aren’t easily changed in a large system. So is there a plan at Ochsner to attack this problem by adjustment in processes as well?”

Brinster said conversations are ongoing around rolling forecasts, revenue and costs to tackle the issue. “Within service lines, I think they are taking a careful, very lean perspective on what can make more money and what’s losing money; however, there have been no concrete changes in our vascular surgery division.”

VB